King Dollar at the precipice: why currency’s reign is in jeopardy

A confluence of structural domestic decay and a quiet global rebellion against US financial dominance has pushed the dollar to a critical technical juncture. A breakdown here would not be a cyclical downturn but could signal a secular shift in the global monetary order. The most potent threat to the US dollar comes not from…

A confluence of structural domestic decay and a quiet global rebellion against US financial dominance has pushed the dollar to a critical technical juncture. A breakdown here would not be a cyclical downturn but could signal a secular shift in the global monetary order.

The most potent threat to the US dollar comes not from a single administration, but from a structural flaw decades in the making: an unsustainable fiscal trajectory.

Long-term projections from the Congressional Budget Office (CBO) show US public debt on a path to exceed 116% of GDP by 2034, driven primarily by structural deficits in mandatory spending on Social Security and Medicare. This issue transcends partisan politics; it is a demographic and fiscal time bomb rooted in an aging population and the political intractability of entitlement reform.

Recent policies have acted as a powerful accelerant. The Committee for a Responsible Federal Budget estimates that President Trump’s proposals alone could add over $5 trillion to the debt over the next decade.

This escalating burden is compounded by the Federal Reserve’s dilemma: Faced with a slowing economy and risks of stagflation, the Fed has pivoted dovish, cutting rates and diminishing the dollar’s yield advantage. This is not a theoretical risk; markets are already repricing the dollar in real time.

The global rebellion and the petrodollar question

While America weakens the dollar from within, the rest of the world has accelerated its search for alternatives. The weaponization of trade and finance under successive US administrations has catalyzed a quiet but determined global rebellion against dollar hegemony.

China and Russia are at the forefront, expanding yuan- and ruble-based trade. According to the IMF’s COFER data, the dollar still accounts for ~58% of global reserves, but this share has been eroding for two decades. The key shift is not just in reserves, but in trade flows: Non-dollar transactions are gaining traction, even if the yuan’s reserve share remains under 3%.

Crucially, this movement is no longer confined to US rivals. In a historic shift, Saudi Arabia – the lynchpin of the petrodollar system, anchoring the dollar to global oil since the 1970s – has signaled openness to settling oil sales in other currencies. While the dollar still dominates energy trade, this is a crack in its foundation.

Meanwhile, the European Union, where the euro already accounts for over 22% of global payments (SWIFT data), is pursuing “strategic autonomy” to strengthen the euro’s global role. India is promoting rupee-based settlements, and the expansion of the BRICS+ bloc provides a political platform to coordinate de-dollarization efforts.

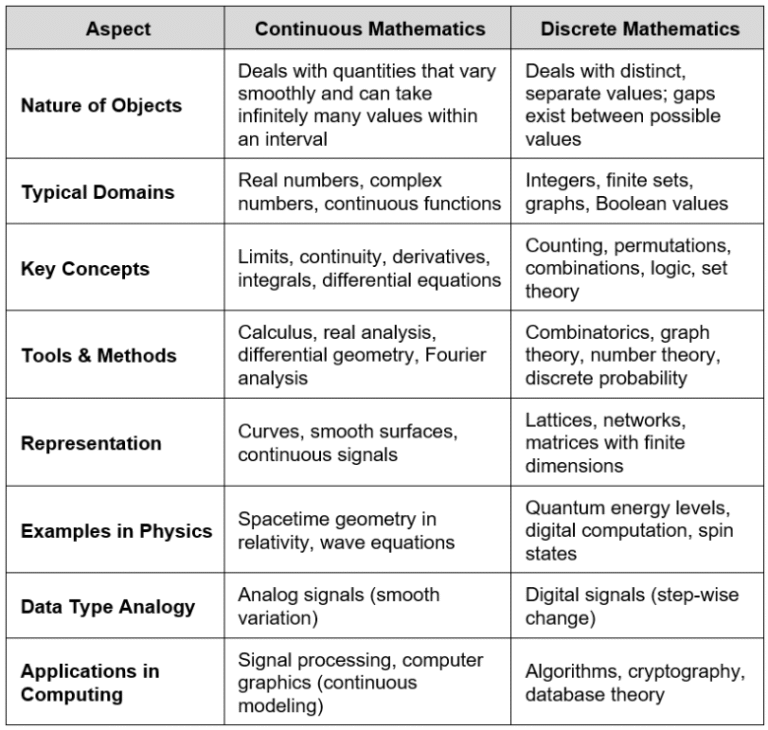

Table 1: converging forces pressuring the US dollar

| Force | Key Drivers (US Internal) | Key Drivers (Global External) | Impact on the Dollar (DXY) |

| Fiscal Decay | Structural deficits (CBO data), accelerated by unfunded tax cuts, rising debt. | Diversification of central bank reserves away from US Treasuries (IMF COFER data). | Negative 📉 (Erodes long-term confidence) |

| Monetary Easing | Fed rate cuts to combat slowing growth and stagflation risk. | Other central banks maintaining relatively stable or less aggressive easing. | Negative 📉 (Reduces yield advantage) |

| Geopolitical Shifts | Weaponization of sanctions and tariffs. | De-dollarization (China/Russia), cracks in petrodollar (Saudi), EU autonomy, BRICS+ push. | Negative 📉 (Reduces structural global demand) |

| Safe-Haven Status | Historical role as ultimate refuge during crises. | A deep global crisis could temporarily override other forces. | Conditionally Positive 📈 (Short-term flight to safety) |

The chart that confirms the narrative

This confluence of powerful forces is reflected in the long-term chart of the Dollar Index (DXY). On the quarterly timeframe, the index is testing a critical support level around 96to 97. This is not mere chart-gazing. Data from the CFTC show speculative positioning increasingly against the dollar, mirroring the erosion of fundamental confidence.

A decisive break below this support zone on a quarterly closing basis would be a powerful technical confirmation that the dollar’s secular bull run, which began after 2008, may be ending. The primary trend could be shifting from bullish to bearish.

Echoes of the 1970s

The dollar’s reign as the undisputed reserve currency is facing its gravest challenge in a generation. The parallels with the early 1970s are striking: Back then, persistent US fiscal and trade deficits, exacerbated by the costs of the Vietnam War, made it impossible to maintain the dollar’s fixed peg to gold.

Today, structural domestic deficits driven by entitlement spending and a global pushback against US financial leadership raise similar fundamental questions about the long-term sustainability of the current system.

The base case is not a sudden, dramatic crash, but an acceleration of the slow, grinding transition to a multipolar currency order. This new landscape would likely feature several key currency blocs – the dollar, the euro and the yuan – competing for influence, leading to increased volatility and more complex hedging needs for international corporations.

The alternative, however, remains possible: In the event of a severe systemic crisis originating outside the United States, the dollar could rally temporarily. This is because the US Treasury market, despite its flaws, remains the only global financial asset deep and liquid enough to absorb a massive flight to safety, reinforcing the dollar’s role as the ultimate safe haven, even if only for a lack of viable alternatives.

For investors, corporations, and governments, the message is clear: The era of assuming a perpetually strong and stable dollar is over. Strategic planning must now account for a more fragmented and volatile currency environment. Central banks will likely continue their gradual diversification, corporations must enhance their currency risk management and investors will need to look beyond traditional dollar assets for long-term value preservation. The king’s reign is no longer guaranteed.

A senior economic analyst and deputy CEO of an oil & gas company based in Tehran, Amirreza Etasi (Amir.etasi@gmail.com) has worked for more than a decade at the intersection of public finance, energy and development policy, both in executive roles and as a contributor to major media outlets in Iran and abroad.