Why 70% of Financial Services Technology Projects Fail (And How to Join the 30% That Succeed): By Sergiy Fitsak

Financial institutions face a critical challenge: accelerating digital transformation while maintaining stringent risk management standards. Technology stack decisions have evolved from technical choices to strategic investments that determine competitive positioning, regulatory compliance capabilities, and operational efficiency. Industry analysis reveals that 70% of enterprise technology projects fail due to inadequate stack selection. For financial institutions, these…

Financial institutions face a critical challenge: accelerating digital transformation while maintaining stringent risk management standards.

Technology stack decisions have evolved from technical choices to strategic investments that determine competitive positioning, regulatory compliance capabilities,

and operational efficiency.

Industry analysis reveals that 70% of enterprise technology projects fail due to inadequate stack selection. For financial institutions, these failures

carry exponentially higher costs – regulatory fines averaging $250 to 500 million per incident, customer attrition, and migration costs that often exceed initial project budgets by 300%.

Regulatory Constraints Shape Technology Decisions

Compliance as an Architecture Requirement

Modern financial regulations impose specific architectural demands that cannot be overlooked. PCI DSS requires secure payment processing architectures.

SOX mandates comprehensive audit trails and data integrity controls. Open banking regulations demand API-first architectures. MiFID II transaction reporting needs real-time data processing capabilities.

These requirements cannot be retrofitted. Institutions prioritizing technical elegance over regulatory compliance often discover their architectures cannot

support required governance, monitoring, and auditability, resulting in costly rebuilds and regulatory penalties.

Competitive Dynamics

Fintech challengers on cloud-native architectures deploy updates weekly rather than quarterly. This velocity advantage stems from technology stack decisions

prioritizing modularity, automation, and rapid iteration.

Traditional institutions must balance innovation speed with operational stability – a challenge requiring sophisticated risk assessment.

Risk Assessment Framework

Operational Risk Factors

Technology selection must account for risks beyond performance and scalability. System downtime results in regulatory reporting failures and compounding

financial losses.

Maintenance activities consume up to 75% of development effort over system lifecycles, often exceeding industry averages in financial services due to legacy

integrations and regulatory requirements.

Security and Vendor Risk Management

Financial services stacks must embed security and compliance as foundational elements while managing vendor dependencies carefully. Subscription-based

pricing models create cost escalation risks, but vendor lock-in presents even greater concerns, particularly regarding data sovereignty and exit strategies.

Institutions must evaluate vendor financial stability, regulatory compliance history, and data residency capabilities. Brexit and evolving global regulations

create additional complexity around where data can be processed and stored, making jurisdiction-aware technology selection critical.

Team Capability Alignment

Stack selection must align with institutional capabilities. Financial institutions typically operate specialized teams with deep expertise in established,

enterprise-grade platforms. Introducing technologies exceeding team capabilities creates productivity risks and knowledge management vulnerabilities.

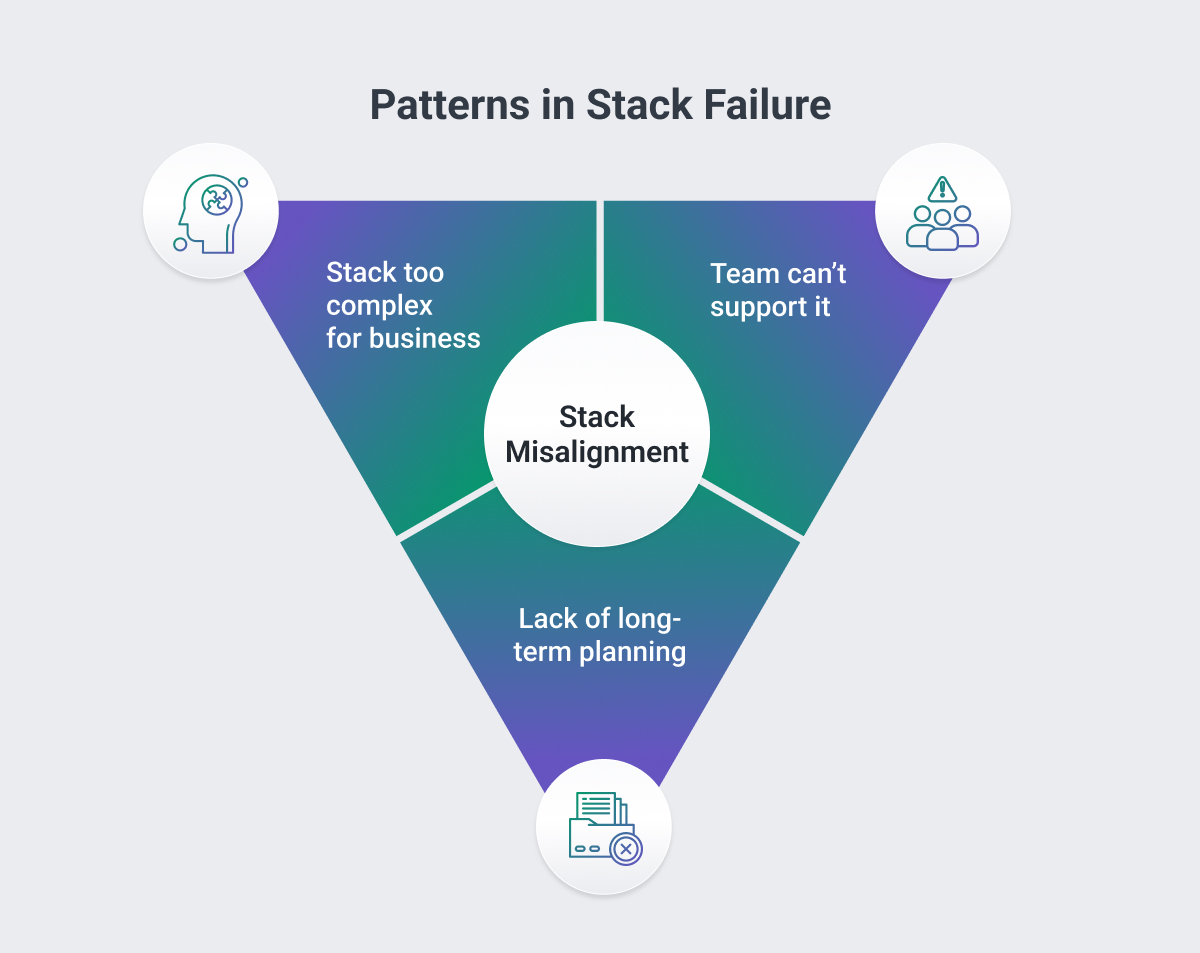

Examples of Common Failure Patterns

Premature Complexity: A regional bank adopted microservices for customer

portal redesign but lacked the necessary DevOps expertise, creating several-month delays.

Requirements Mismatch: A wealth management firm selected a high-performance

mobile framework lacking required security controls, necessitating extensive customization that eliminated cost savings.

Scaling Oversight: A payments processor’s traditional database architecture

experienced cascading failures as transaction volumes grew, requiring a multi-million-dollar emergency migration to distributed systems and months of service disruptions.

Core System Integration Challenge: A mid-tier bank’s modern customer

portal couldn’t integrate effectively with their 1990s core banking system, requiring expensive middleware development that doubled the project timeline and created ongoing maintenance burdens.

Strategic Selection Framework

Business-Technology Alignment

Effective selection requires comprehensive analysis extending beyond functional specifications to regulatory constraints, core banking system integration

requirements, and business continuity demands.

Financial institutions require 99.9%+ uptime and robust disaster recovery capabilities that many modern technologies cannot guarantee without significant

architectural investment.

Institutions should prioritize technologies supporting current needs, anticipated regulatory evolution, and seamless integration with decades-old core

banking systems that cannot be easily replaced.

Risk-Adjusted Evaluation

Financial services require evaluation frameworks incorporating compliance capabilities, operational risk factors, and maintainability considerations. Security

must be evaluated as core functionality rather than peripheral features.

Implementation Strategy

Success requires governance frameworks maintaining institutional control while enabling innovation. Phased implementation validates technologies in controlled

environments before deployment in customer-facing systems.

Competitive Advantage Through Strategic Decisions

Operational Efficiency

Well-designed stacks enable significant efficiency improvements while maintaining compliance standards. Automation reduces manual intervention, improves

consistency, and enables strategic talent deployment.

Market Responsiveness

Strategic decisions create capabilities extending beyond immediate requirements. Institutions with modern, modular architectures respond rapidly to competitive

pressures, regulatory changes, and customer experience demands.

Implementation Recommendations

Financial institutions should treat technology stack selection as strategic capability development. Success requires comprehensive risk assessment, stakeholder

alignment, and governance frameworks supporting innovation and stability.

The most successful implementations balance proven reliability with selective modern capability adoption.

This approach enables technological advancement benefits while maintaining operational stability that financial services stakeholders demand.

Technology stack decisions represent foundational investments influencing institutional capabilities for years. Institutions developing sophisticated selection

capabilities achieve sustainable competitive advantages through superior efficiency, regulatory responsiveness, and customer experience delivery.