BMP Flags 6.2% Inflation as Signal of Structural Economic Risks

By Dr Ansab AliLAHORE (Pakistan): The Businessmen Panel (BMP) of the Federation of Pakistan Chambers of Commerce and Industry (FPCCI) has expressed deep concern over the latest rise in inflation, warning that the economy is once again showing signs of strain as consumer prices climbed by 6.2 percent in October 2025 — the highest level…

By Dr Ansab Ali

LAHORE (Pakistan): The Businessmen Panel (BMP) of the Federation of Pakistan Chambers of Commerce and Industry (FPCCI) has expressed deep concern over the latest rise in inflation, warning that the economy is once again showing signs of strain as consumer prices climbed by 6.2 percent in October 2025 — the highest level in a year — driven largely by food supply disruptions, flooding, and trade bottlenecks along Pakistan’s western borders.

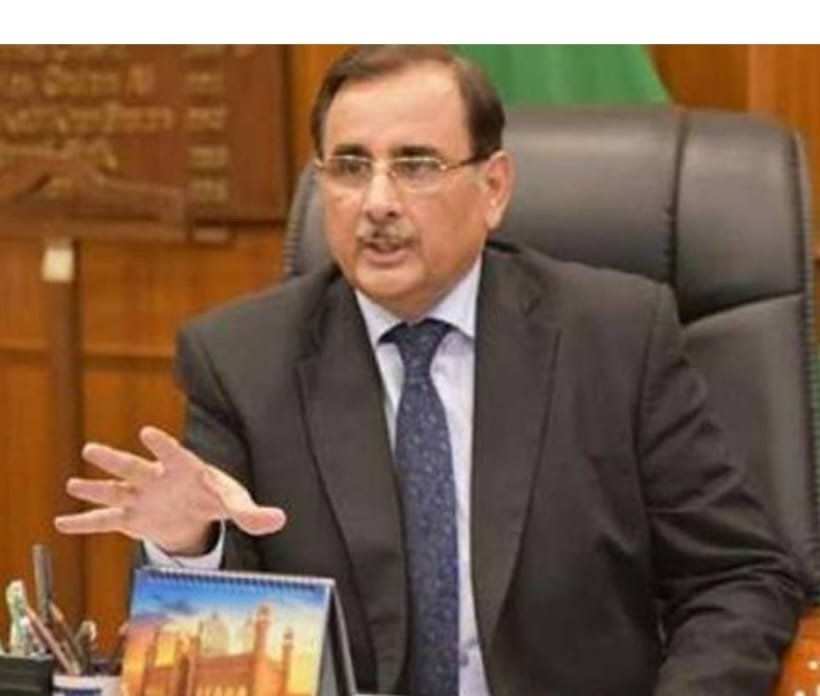

FPCCI former president and BMP Chairman Mian Anjum Nisar said that while headline inflation had eased earlier in 2025, the latest data marks a reversal of that trend and reflects persistent structural weaknesses in the economy. He noted that the surge in food prices, particularly vegetables and fruits, followed devastating floods in Punjab and border closures with Afghanistan, which disrupted trade and restricted the supply of essential commodities.

He observed that the government’s projection of 5–6 percent inflation for October was overtaken by a sharper rise, driven by temporary shocks and continued fiscal pressures. “These disruptions reveal the fragility of our supply chain and the urgent need for resilience planning in agriculture and logistics,” he said, adding that even short-term interruptions quickly translate into higher consumer prices.

Mian Anjum said the State Bank of Pakistan’s decision to maintain the policy rate at 11 percent for the fourth consecutive meeting reflected a cautious stance. However, he warned that inflation persistently above the official target range could limit monetary flexibility in the coming months. He emphasized that inflation management cannot rely solely on monetary tightening and that fiscal prudence and real-sector reforms are essential to anchor price stability.

He pointed out that inflation had fallen below six percent in mid-2025 after two years of record highs but is now climbing again due to base effects, administrative price adjustments, and a weaker rupee. The trend, he warned, threatens to slow industrial recovery and erode purchasing power, as businesses already face higher energy tariffs, rising taxes, and subdued domestic demand.

Recalling the impact of the August floods, he said vast farmland and industrial zones were submerged, over a thousand people lost their lives, and millions were displaced. Meanwhile, border clashes with Afghanistan led to the closure of major crossings critical for food and fuel trade. Although a temporary ceasefire was later reached, trade movement remained restricted, resulting in commodity shortages and price spikes across northwestern Pakistan.

The BMP statement noted that these external shocks have compounded internal structural problems such as excessive government borrowing, weak tax compliance, and high energy costs — all of which continue to erode business confidence.

Mian Anjum urged the government to move beyond short-term administrative controls and pursue comprehensive structural reforms focused on productivity, fiscal discipline, and broadening the tax base. He acknowledged the State Bank’s positive outlook on improved crop output and modest industrial recovery but warned that the private sector remains under pressure from rising input costs and shrinking profit margins.

He pointed out that the HBL Pakistan Manufacturing PMI remains below the 50-point mark, indicating weak demand and sluggish industrial output.

Calling for a coordinated policy response, the BMP chief stressed the need for better alignment between fiscal and monetary authorities to maintain price stability without undermining growth. He also recommended rationalizing energy prices, improving border trade management, and accelerating agricultural rehabilitation in flood-affected areas to prevent further food inflation.

“Inflation is not just a statistical concern but a reflection of deep-rooted inefficiencies that demand structural change,” Mian Anjum said. He underscored that rising prices disproportionately hurt low-income households and small enterprises, and urged the government to focus on stability, fiscal discipline, and transparency to rebuild business confidence.

According to the BMP, the latest inflationary spike serves as a reminder that Pakistan’s economy remains vulnerable to both natural and policy-induced shocks. The group reiterated its call for broad-based reforms, efficient governance, and sectoral diversification to reduce reliance on imported inputs and speculative currency movements.

Mian Anjum concluded that unless decisive measures are taken to strengthen supply chains, rationalize energy pricing, and support domestic production, inflation could continue to undermine growth momentum and investor sentiment in the coming months. He expressed hope that the government would act swiftly to stabilize prices and safeguard the fragile economic recovery.