Federation of Pakistan Chambers of Commerce and Industry Warns of Rising Losses in State-Owned Enterprises

By Farzana Chaudhry | Lahore, PakistanThe Federation of Pakistan Chambers of Commerce and Industry (FPCCI) Businessmen Panel (BMP) has raised serious concerns over the worsening financial performance of the country’s state-owned enterprises (SOEs), warning that the sector’s growing losses threaten fiscal stability and economic competitiveness.According to FPCCI President and BMP Chairman Mian Anjum Nisar, SOEs…

By Farzana Chaudhry | Lahore, Pakistan

The Federation of Pakistan Chambers of Commerce and Industry (FPCCI) Businessmen Panel (BMP) has raised serious concerns over the worsening financial performance of the country’s state-owned enterprises (SOEs), warning that the sector’s growing losses threaten fiscal stability and economic competitiveness.

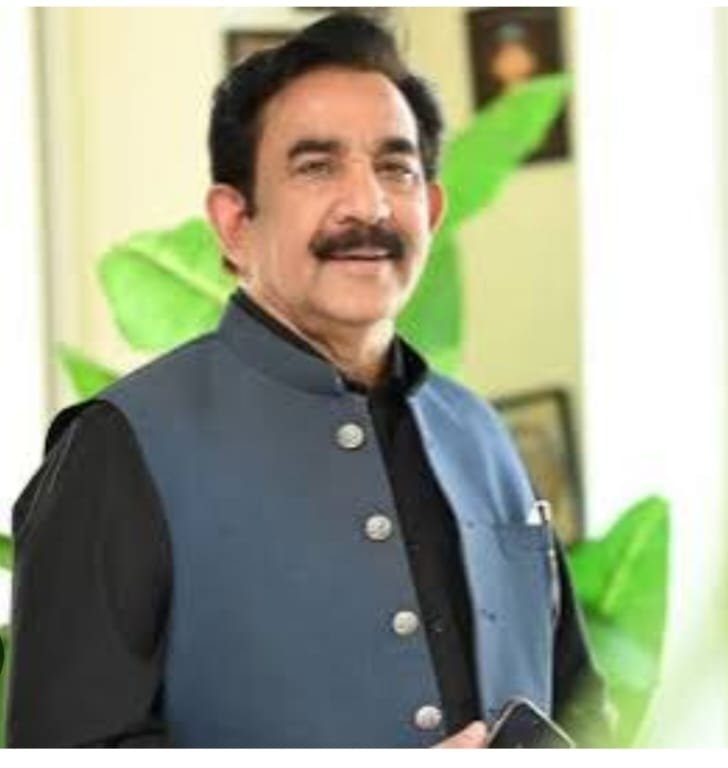

According to FPCCI President and BMP Chairman Mian Anjum Nisar, SOEs absorbed Rs 2.1 trillion in fiscal year 2025—almost 16 percent of federal tax revenues—while reporting a net adjusted loss of Rs 122.9 billion, up sharply from Rs 30.6 billion the previous year. Total debt across the sector now exceeds Rs 9.5 trillion, reflecting structural inefficiencies and chronic governance weaknesses.

Nisar singled out the power sector as particularly problematic, noting that despite repeated capital injections aimed at addressing circular debt, liabilities continue to mount. He warned that unfunded pension obligations, weak financial planning, and politically influenced board appointments undermine operational efficiency and fiscal discipline.

The BMP chairman also highlighted the distortionary effect of sovereign guarantees and government-backed loans, saying such support reduces incentives for cost optimization, innovation, and strategic restructuring. “Every rupee used to plug recurring SOE losses reduces the government’s capacity to invest in infrastructure, education, healthcare and industrial modernization,” he noted.

Nisar called for urgent reform measures, including a time-bound restructuring and privatization roadmap for loss-making SOEs, merit-based appointments, and linking fiscal support to clear performance indicators and turnaround milestones. He emphasized that commercially viable entities should be restructured with private sector participation, while non-strategic enterprises should be privatized through transparent competitive processes.

The BMP also urged rationalization of pension liabilities, adoption of modern financial management systems, and prioritization of asset optimization over expansionary spending. Nisar stressed that fiscal space created through these reforms should be redirected toward growth-enhancing measures, including lower industrial electricity tariffs, export diversification, support for SMEs, and reduced tax burdens on documented businesses.

He concluded that restoring fiscal credibility and enforcing accountability within SOEs are critical to protect taxpayers’ money and place Pakistan on a sustainable, investment-led growth trajectory.